RDS Fund Sp. z o.o. w ramach projektu Projekt Bridge_Alfa „Nowa Ziemia Obiecana Seed Fund” ogłasza VII falę naboru innowacyjnych projektów w zakresie obejmującym Krajowe Inteligentne Specjalizacje (KIS):

Szczegóły zakresu KIS: https://smart.gov.pl/pl/

Projekt Bridge_Alfa „Nowa Ziemia Obiecana Seed Fund” jest współfinansowany z Europejskiego Funduszu Rozwoju Regionalnego w ramach Działania 1.3. Programu Operacyjnego Inteligentny Rozwój w ramach konkursu Narodowego Centrum Badań i Rozwoju: BRIdge Alfa.

ZapraszamyZmotywowane Zespoły, Pomysłodawców i Innowatorów do składania zgłoszeń projektów innowacyjnych o wysokim potencjale komercjalizacji zgodnie z zakresem wskazanych Krajowych Inteligentnych Specjalizacji na załączonym Formularzu Zgłoszeniowym.

Najlepszym wybranym przez RDS Fund Sp. z o.o. projektom oferujemy finansowanie:

PoP (Proof-of-Principle) – faza projektu B+R, polegająca na wczesnej weryfikacji pomysłu, przez prace badawczo-rozwojowe, wstępną ocena potencjału Projektu B+R, analizy otoczenia konkurencyjnego, zdefiniowanie planu badawczego i pierwszych kamieni milowych rozwoju Projektu B+R, której realizacja możliwa jest m.in w jednostkach naukowych (uczelnie, instytuty naukowe PAN, instytuty badawcze, inne jednostki naukowe) lub poprzez przez osoby fizyczne lub dedykowane zespoły projektowe (wynalazcy, pomysłodawcy), której prowadzenie nie będzie zasadniczo związane z odrębnym prawnie podmiotem dedykowanym do realizacji projektu B+R.

Oczekiwany poziom finansowania PoP do kwoty 50 tys. zł.

PoC (Proof-of-Concept) – faza projektu B+R polegająca na właściwej weryfikacji pomysłu, w czasie której realizowane są badania przemysłowe i prace rozwojowe, których wyniki (jeśli pozytywne) w typowych sytuacjach umożliwią pełne zgłoszenie patentowe lub przejście do fazy międzynarodowej zgłoszenia pierwszeństwa w trybie PCT lub komercyjne wykorzystanie wyniku projektu B+R, realizowana przez prawnie wyodrębniony podmiot dedykowany do realizacji projektu B+R.

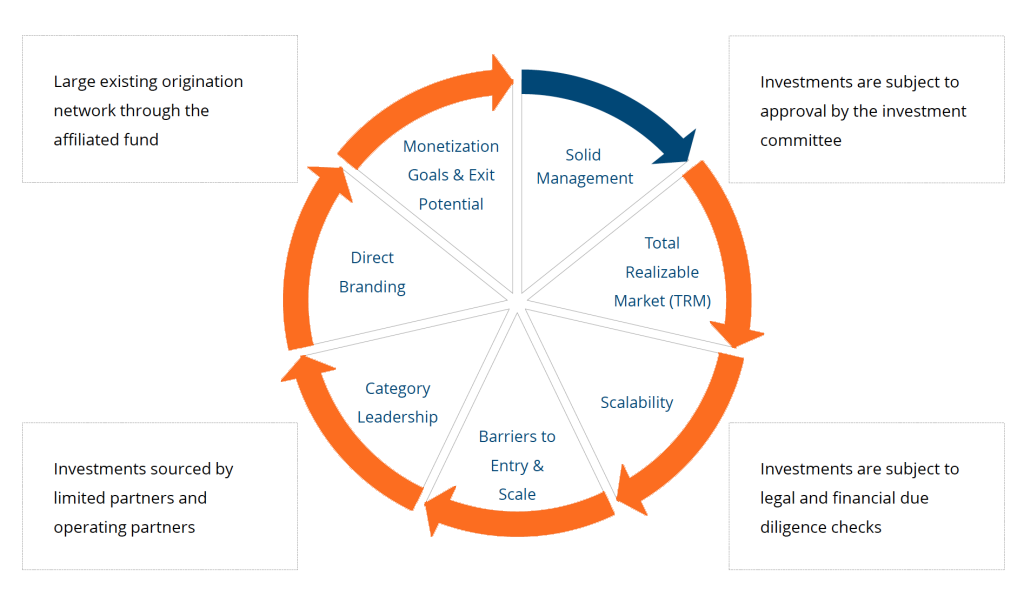

Finansowanie fazy PoC odbywa się przez inwestycję kapitałową Funduszu (objęcie udziałów/akcji) w istniejącej lub nowo powołanej spółce kapitałowej realizującej projekt B+R oraz grant NCBR w łącznej kwocie na projekt do 1.1oo tys. zł.po zatwierdzeniu projektu przez nasz Komitet Inwestycyjny.

Możliwe jest finansowanie dla jednego projektu fazy PoP a następnie(po pozytywnym wyniku) fazy PoC.

Ostateczny termin zgłoszeń VII fali projektów upływa 30 czerwca 2022r do godziny 23.59.

Zgłoszenia projektowe na naszym Formularzu Zgłoszeniowym i/lub materiały informacyjne o projekcie prosimy przesyłać na adres e-mail: info@rdsfund.com

Decyzję Zarządu RDS Fund Sp. z o.o. o wyniku analizy projektu co do możliwości dofinansowania fazy PoP projektu przekażemy Pomysłodawcom i Zespołom do 31 Lipca 2022rr mailowo na wskazany w formularzu zgłoszeniowym adres kontaktowy e-mail.

Jeżeli Wasz projekt jest przygotowany i gotowy do wstępnej oceny nie czekajcie na ostateczne terminy zgłoszeń. Prześlijcie projekt już dziś, w terminie do 3 tygodni otrzymacie informację zwrotną dotyczącą możliwości dofinasowania fazy PoP, ponieważ poszukujemy najlepszych projektów o wysokim potencjale komercjalizacji i są one dla Nas priorytetowe.

Zaplanowaliśmy konsultacje w formie webinariów o których informować będziemy na bieżąco na naszym funpage:

Liczymy na Wasz innowacyjny potencjał i projekty o wysokim potencjale komercjalizacyjnym i oczekujemy na zgłoszenia.

Celem inwestycyjnym Projektu jest powołanie, wyinkubowanie i przygotowanie do ekspansji zagranicznej oraz kolejnej/kolejnych rund finansowania, 38 zmotywowanych do dalszego rozwoju, innowacyjnych spółek kapitałowych, opartych na co najmniej 2 osobowym zespołach złożonych: z przedsiębiorcy „entrepreneur” i technologa „haker” - posiadających globalny potencjał rozwojowy.

Stawiamy sobie za cel wyszukanie i realizację projektów o najwyższym potencjale rozwojowym ze względu na swój globalny zasięg. Nasze spółki mają osiągnąć gotowość absorpcji kolejnych rund finansowania kapitałowego w ciągu 12-18 miesięcy.

Całkowita wartość środków zarządzanych przez Zarządzającego (RDS Fund Sp z o.o.) z uwzględnieniem kwoty dotacji z NCBiR wynosi 49 577 200 PLN, a w tym kwota dotacji od NCBiR 39 360 000 PLN, kwota wpłacana przez inwestorów prywatnych 10 217 200 PLN. Docelowo środki pieniężne zaangażowane w Portfel wynoszą 41 mln PLN (objęcie udziałów plus dotacja) z czego 8,2 mln PLN stanowi wydatek ASI (ASI RDS Fund spółka z ograniczoną odpowiedzialnością spółka komandytowa) na objęcie udziałów/akcji w spółkach Portfela.

Projekt współfinansowany/finansowany przez Narodowe Centrum Badań i Rozwoju w ramach programu BridgeAlfa.

Skonkretyzowany przedmiot inwestycji Funduszu, dotyczący szybko rozwijającej się i bardzo perspektywicznej dziedziny rynku o strategicznym znaczeniu dla bezpieczeństwa Polski i regionu.

Niezależni międzynarodowi eksperci i partnerzy branżowi operujący w skali globalnej pomagają zespołowi RDS Fund w wyborze najkorzystniejszego scenariusza rozwoju i komercjalizacji dla każdej ze spółek.

Odpowiedni pod względem kompetencji i doświadczeń (oraz w związku ze specjalizacją inwestycyjną), a także zdeterminowany zespół RDS Fund Sp. z o.o. (zespół zainwestował ponad 100 mln PLN).

Inwestowanie w przedsięwzięcia oparte na unikalnym w skali światowej polskim IP, tworzonym i identyfikowanym we współpracy z wiodącymi krajowymi uczelniami i placówkami naukowymi, podnoszące prawdopodobieństwo sukcesu rynkowego (także w skali globalnej) finansowanych przedsięwzięć.

Doświadczenie zespołu oraz współpraca RDS Fund z inwestorami o różnym profilu inwestycyjnym ułatwia przygotowanie projektów do pozyskania z rynku kolejnych rund finansowania, komercjalizacji i wyjścia Funduszu z inwestycji.

Przemyślany i dobrze ustrukturyzowany proces inwestycyjny w fazie Proof-of-Principle i Proof-of-Concept oraz rozsądny budżet projektu, przewidujący odpowiednie zaangażowanie na każdym etapie finansowania.

Produkty lecznicze chemiczne i biologiczne, biotechnologia, nowe technologie (ATMP, HE); Wyroby medyczne, suplementy diety, żywność funkcjonalna - specjalnego przeznaczenia medycznego;

e-Medycyna, Internet rzeczy, Cybersecurity a w szczególności:

wykorzystanie uczenia maszynowego i sztucznej inteligencji do zmian w sposobie funkcjonowania medycyny ale też rozrywki, sportu, biznesu 4.0.,

rozwiązania zapewniające bezpieczne przechowywanie danych tele-medycznych / metrycznych oraz ich bezpieczne przesyłanie do odpowiednich serwisów.